Discover essential tips for collecting Disneyana, from sourcing rare finds to preserving your treasures. Dive into your passion for collecting today!

Ultimate Guide to Disneyana: Why Fans Become Collectors

Disneyana is a captivating world that intertwines nostalgia, artistry, and a deep-seated connection to the enchanting stories created by the Walt Disney Company. Disneyana spans nearly a century and includes a wide range of memorabilia, from attraction props and iconic movie celluloids to early toys, posters, pins, and limited editions. Each piece reflects Disney’s rich storytelling legacy and the magic that captivates generations.

The term “Disneyana” was first introduced in 1974 with the publication of the book “Disneyana: Walt Disney Collectibles” by Cecil Munsey. This comprehensive guide explores the essence of Disneyana, tracing its origins and highlighting the passionate fan base that emerged in the 1980s and 1990s. It also examines the current landscape of collecting that continues to thrive today. Join us as we embark on a journey through the enchanting worlds of Disney parks, films, and the lasting memories from the Walt Era.

Where Disneyana Begins: Parks, Films, and the Walt Era

Disneyana collecting is a vibrant and diverse hobby that celebrates the rich history of Disney through a wide range of memorabilia. From classic toys and movie collectibles to rare park items, understanding the different eras of Disney helps collectors focus their collections and enhance their appreciation for this beloved brand.

Parks

As Disneyland approaches its 70th Anniversary in 2025, interest in early park memorabilia—especially items from before the 1960s—has surged. Collectors are keen to find artifacts that capture the park’s original magic and history, making this segment particularly sought after in the current market.

Films

In the realm of film collectibles, items associated with the first release in a series tend to gain value over time. Collectors should pay attention to unique and popular pieces, as these often appreciate significantly. The nostalgia attached to these films contributes to their desirability and investment potential.

Toys

Vintage Disneyana includes a treasure trove of toys from the “Golden Age” (1928–1966), featuring early Mickey Mouse dolls, tin wind-up toys, and more. When assessing value, condition is paramount items in pristine condition, particularly those from the 1930s, can command prices exceeding $1,000, making condition a critical factor for collectors.

Walt Era collectibles

Rare Disney collectibles often trace back to the Walt Era, highlighting items tied directly to Walt Disney’s animation work and Disneyland’s formative years. Additionally, unique items crafted specifically for cast members can offer a fascinating glimpse into Disney’s history.

Disney Parks Collectibles: Souvenirs, Props, and Limited Releases

Park-specific items are among the most coveted categories in the world of Disneyana. These unique collectibles often evoke memories of magical moments spent in the parks, making them highly desirable among fans and collectors alike.

Exclusive tickets and passes

One of the standout items in the park-specific category is the Disneyland Opening Day ticket, particularly the invitational Press Preview pass. This exclusive ticket was issued only for the televised grand opening of Disneyland, making it a rare gem for collectors. Additionally, the Walt Disney World Tour guide costume pin from the 70s and 80s, exclusive to park employees, further underscores the significance of era-specific memorabilia.

Ephemera

Ephemera such as napkins, brochures, programs, posters, and postcards also hold great value among Disney fans. These items not only serve as tangible reminders of special visits but also offer a glimpse of the parks’ changing landscape over the years. Collecting these pieces can be an exciting journey through Disney history.

Park-specific souvenirs

Disney parks are renowned for their vast array of souvenirs, offering something for every visitor. From classic items to limited editions, these souvenirs allow guests to take a piece of the park home. Park-specific souvenirs are designed to commemorate unique experiences tied to each Disney location. Whether it’s a themed mug or apparel, these items serve as reminders of individual trips. Era-specific souvenirs also allow fans to celebrate the history and evolution of the parks, enhancing their collections.

Limited editions and holidays

Limited-edition souvenirs, often released during special events or celebrations, tend to appreciate in value quickly. Holiday-themed items, such as Christmas ornaments or Halloween merchandise, add another layer of excitement for collectors seeking to capture the essence of different festive seasons at the parks.

Props and memorabilia

Attraction-used props and themed memorabilia provide fans with a deeper connection to their favorite rides and experiences. These items range from retired animatronics to park signage, each telling a story of the park’s history. Collecting ride props, such as elements from iconic attractions, allows fans to bring a piece of Disney magic into their homes. Retired animatronics, once integral parts of various rides, hold a special allure for collectors due to their significance in the overall park experience.

Park signs

Park signs, including directional signage and shop indicators, are another fascinating area of collecting. These signs, ranging from functional to whimsical, evoke nostalgia and offer insight into the park’s layout and attractions over time.

Pins, Figurines, and Toy Lines: Small Items With Big Followings

Disney collectibles can include a wide range of items, from hand-sewn dolls to limited-edition figures and digital treasures.

Pin trading

Pin trading is a beloved tradition within the Disney fandom that captivates fans of all ages. First emerging in the late 1990s, this engaging activity allows Disney enthusiasts to trade pins with each other and with cast members at the parks. Among the pins available, rare releases and event-only selections are especially sought after, making them highly desirable collectibles.

Disney figurines

In addition to pins, Disney figurines have become immensely popular collectibles. Vintage figures, modern vinyl toys, and intricate character statues attract collectors who adore Disney’s charm. Vinylmation figures and limited edition MagicBands are modern collectibles related to Disneyana. Particularly with the excitement of blind box collections and the thrill of discovering secret, rare pulls.

Character specific

Toy lines featuring Disney characters represent another fascinating facet of the collecting culture. Fans love to seek out items that feature their favorite characters, and the variety is endless. With such a broad array of options, Disney collectibles cater to a variety of interests.

Main Characters: Mickey Mouse to Disney Princesses

Disney’s enchanting universe is filled with classic characters like Donald Duck, Mickey Mouse, Minnie Mouse, and Daisy Duck. Disney princesses, including beloved characters such as Snow White, Cinderella, and Ariel. It also showcases the charm of Winnie the Pooh and The Muppets, featuring Miss Piggy.

Disney animation: Peter Pan, The Lion King, and Pixar

brought timeless classics like The Lion King, Robin Hood, and Peter Pan, while Pixar introduced memorable characters from WALL-E and Toy Story, like Buzz Lightyear.

Side characters: The Seven Dwarfs, Disney Villains, and Other

Side characters, including the Seven Dwarfs and the Cheshire Cat, add depth, while iconic villains like Cruella de Vil and the Evil Queen provide thrilling moments. Live-action classics like Mary Poppins and the quirky tones of The Nightmare Before Christmas, featuring Jack Skellington and Oogie Boogie, further enrich this imaginative tapestry that continues to captivate audiences.

The Role of Auctions in Disneyana

Disneyana auctions have become a prominent space for collectors and enthusiasts alike, providing an exciting glimpse into the world of Disney memorabilia. These auctions showcase rare items and reflect market trends in Disney collectibles, enhancing the collecting experience.

The origins of Disneyana auctions

The very first major Disneyana-specific auction took place at Sotheby’s in Los Angeles on May 14, 1972. This landmark event marked the beginning of a unique niche within the collectibles market, where passionate fans could acquire significant pieces of Disney history. Since then, the interest in Disneyana has only grown, with auctions becoming a hub for not just procurement but also appreciation of Disney art and memorabilia.

Multi-generational collections

Major auctions frequently showcase multi-generational Disneyana collections that offer a diverse array of items, including rare artwork, props, and early park signage. These collections serve as a testament to Disney’s enduring legacy and provide insight into collectors’ shifting tastes over the years. Attending these events allows participants to better understand the pricing and authenticity markers that define high-value items in the Disneyana market.

Online auctions

With the rise of the internet, online auctions have transformed the way collectors acquire Disney memorabilia. eBay has emerged as a popular platform where enthusiasts can find a vast selection of Disney collectibles. Use custom eBay searches to streamline your collecting process and receive notifications for new listings.

Authenticity and Identifying Genuine Disneyana

With such a large fanbase, the world of Disneyana collectibles is rife with replicas and unlicensed merchandise. To safeguard against misidentified or counterfeit pieces, collectors must be diligent in their verification process. This involves carefully checking markings, manufacturer tags, release numbers, and provenance to ensure the authenticity of each item.

Market value

One of the key strategies for collecting Disneyana effectively is thorough research. By comparing prices from various sources, collectors can gain insight into the fair market value of items. The most sought-after Disneyana collectibles can sell for small fortunes, while beginner collectors can build a collection without breaking the bank by focusing on smaller vintage items.

Authentication

Authentication is a critical step in the collecting process, and it should be performed by recognized experts. Collectors seeking to verify their merchandise can turn to professionals acknowledged by the Walt Disney Archives. Ensuring that an item is authenticated by the right authority adds an extra layer of confidence when adding pieces to a collection.

Factors influencing value

When it comes to Disney collectibles, certain items tend to appreciate in value more than others. Scarcity and historical significance are key factors that drive the value of rare Disney collectibles. The first in a series is particularly noteworthy, as these pieces often appreciate significantly over time. Additionally, unique and popular items can command high prices due to their scarcity and demand among fellow collectors.

Storing and Displaying a Disneyana Collection

When it comes to building and maintaining a Disney collectibles collection, proper care and organization are key to ensuring your treasured items remain in pristine condition for years to come.

- Proper Storage: Proper storage is essential for preserving Disney collectibles, preventing fading, warping, and environmental damage. Use archival sleeves for paper goods and store toys and figures away from direct sunlight. For framed prints and animation cels, use UV-filtered glass to reduce sun damage.

- Displaying Your Collection: Displaying your Disney collectibles enhances your space and showcases your passion. Choose display areas free of direct sunlight and humidity to protect the integrity of your items while keeping them accessible and visually appealing.

- Organizing Your Collection: It is crucial for managing and appreciating your investments. Keep detailed records of acquisitions, including descriptions, purchase dates, and prices. This helps you easily locate items and maintain an efficient inventory.

Digital Age Disneyana: NFTs, Modern Releases, and Online Trading

The world of collectibles is continually evolving, particularly with the rise of new items such as digital releases, online-exclusive merchandise drops, and special-event collectibles. These modern additions have expanded collectors’ horizons, making it easier to discover and acquire unique pieces.

Online forums and communities play a crucial role in this transformation, providing platforms where enthusiasts can trade, identify, and assess the value of their collections with unprecedented ease. Among these, Disneyana collectibles and Disney movie memorabilia hold a special charm, drawing in fans from all walks of life and enhancing the joy of online Disney collecting.

What Drives Value in Disneyana?

When it comes to Disney collectibles, several key factors significantly impact their market value. Rarity, character popularity, park association, condition, and era all play critical roles in determining how much collectors are willing to pay.

- Rarity and Popularity: Rarity stands out as one of the most crucial elements in the valuation of Disneyana. Items that are rare or linked to beloved characters can see a steep appreciation in value. Collectibles tied to defunct attractions or discontinued characters particularly draw attention, as these unique pieces often become highly sought after.

- Condition and Era Considerations: The condition of an item is also vital in assessing its worth. Collectibles in pristine condition typically command higher prices, while items showing wear or damage may see their values decrease. Additionally, the era of the collectible can influence its desirability; items from earlier periods often resonate more with nostalgic collectors.

- Collecting for Investment: Collecting Disneyana for investment purposes can be challenging. External variables, such as market trends and shifts in collector interest, can significantly impact the value of collectibles. As such, potential investors must remain aware of the broader market landscape.

- Limited Editions: Limited Edition and Collector’s Edition items are often marketed with the expectation of future value appreciation. This marketing approach can influence the resale market, with many collectors purchasing these items not only for personal enjoyment but also as a means of investment.

Building a Disneyana Collection: Start With What You Love

Collecting Disneyana can be an exciting and rewarding hobby for fans of all ages. With a vast array of collectibles available, many collectors choose to focus on specific themes that resonate with them, such as parks, characters, decades, or limited editions.

The joy of collecting

Collecting is often more enjoyable when approached with a spirit of fun rather than as a means of investment. The unpredictability of the collectibles market can lead to disappointments, but when you collect items that bring you joy, the experience becomes more fulfilling. A personal touch can enhance your collection, ensuring that each piece holds significance.

Setting a budget

Establishing a budget is essential for successful Disneyana collecting. This financial plan helps prevent impulsive purchases that may lead to overspending. By knowing how much you’re willing to spend, you can make informed decisions about the items you wish to add to your collection while maintaining control over your finances.

Where to buy Disney collectibles

Disney collectibles can be found in various locations. One of the best places to find authentic items is directly from Disney theme parks, where exclusive merchandise is often sold. Additionally, flea markets and garage sales can yield hidden treasures, although the selection may vary. Exploring different venues can uncover unique pieces that enhance your collection.

Networking with other collectors

Networking is a valuable aspect of building a successful Disneyana collection. Engaging with other collectors can provide guidance, create opportunities to buy and sell, and enrich the overall collecting experience. Attending major events like the DFC Expo or D23 Expo is a fantastic way to connect with fellow enthusiasts and discover rare items. Additionally, the Disneyana Fan Club stands as the oldest independent non-profit dedicated to preserving Disney’s legacy and can serve as a great resource for collectors.

What to avoid

As you embark on your Disneyana collecting journey, it’s crucial to know what to steer clear of. Items marketed specifically as collectibles tend to be produced in higher quantities, which can diminish their potential value over time. Instead, focus on collecting unique pieces that may not be labeled as collectibles. These hidden gems often appreciate in value, making your collection even more meaningful.

FAQ

How can I tell if a Disney collectible is authentic or a replica?

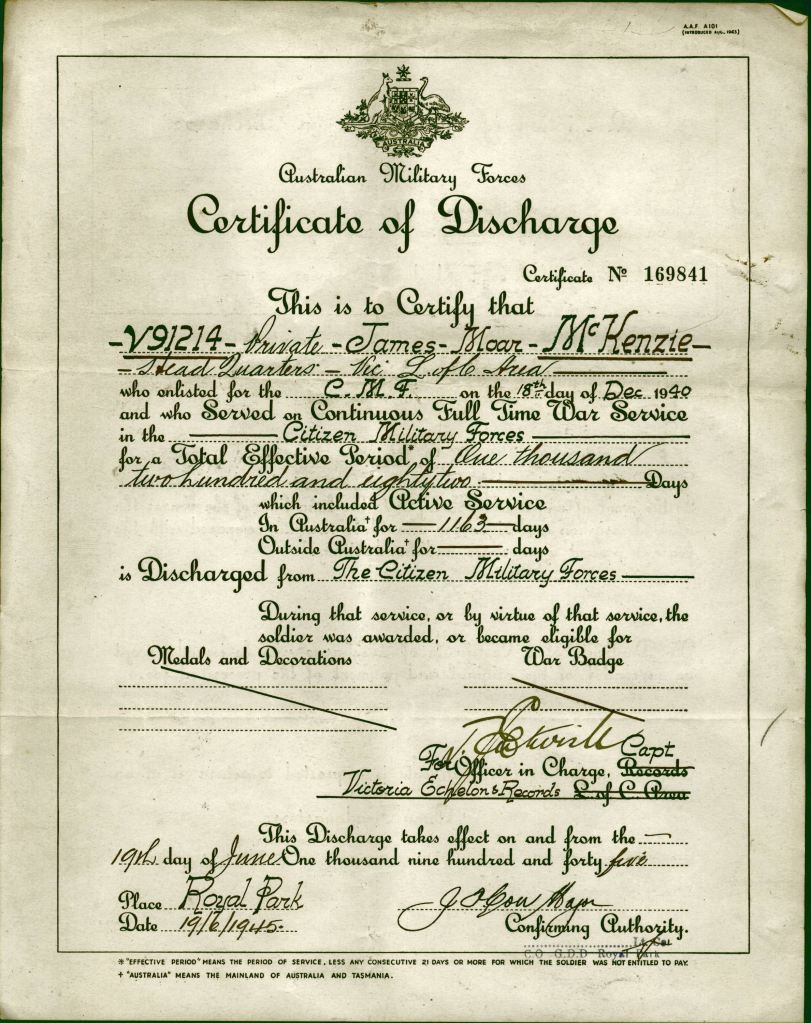

Start by looking for verifiable identifiers and a believable paper trail, not just a convincing look. For most Disneyana categories, strong authenticity checks include:

- Maker marks + tags: manufacturer stamps, copyright lines, edition numbers, hang tags, fabric labels, or casting marks that match known originals.

- Release details: compare the item to known examples—correct colors, materials, dimensions, packaging style, and era-appropriate printing methods.

- Provenance: receipts, auction records, original park purchase documentation, cast-member paperwork, or prior collection records add credibility.

- Source reputation: established auction houses, reputable dealers, and recognized Disneyana communities reduce risk compared to random listings.

If anything feels off—generic “COA,” mismatched fonts/logos, suspiciously “perfect” condition for an older piece, or a seller who won’t share photos/close-ups—treat it as a red flag and consider third-party authentication for higher-value items.

Which types of Disneyana tend to appreciate most over time?

Appreciation isn’t guaranteed, but items that combine scarcity + strong demand + historical significance tend to hold up best. Collectors often see stronger long-term interest in:

- Early park ephemera and rare tickets/passes (especially from early Disneyland/Walt-era eras)

- Park-used or attraction-related items (signage, retired attraction elements, cast-member-only pieces)

- Production-related film material (animation cels, key art, certain studio-used items) when well documented

- Truly limited releases with enduring character appeal (low edition sizes, event-only items, discontinued lines)

Condition and documentation matter a lot—two identical items can perform very differently depending on preservation and provenance.

What’s the safest way to store vintage Disney newspapers, maps, or park ephemera?

For fragile paper, the goal is stable, dry, and dark storage with archival materials that won’t leach acids into the paper. Best practices:

- Use acid-free, lignin-free folders and archival boxes sized so items lie flat (maps/posters should be stored flat whenever possible).

- Separate newsprint from other items—newspapers are highly acidic and can stain adjacent pieces. Use acid-free tissue or interleaving sheets.

- Choose safe sleeves: archival polyester sleeves can work well for handling protection; avoid PVC plastics.

- Control the environment: store in a cool, dry space away from sunlight, heat vents, exterior walls, basements, and attics; avoid humidity swings.

- Handle carefully: clean, dry hands; support fragile pieces fully; avoid folds and adhesives.

If something is extremely brittle or valuable, consider consulting a paper conservator before flattening, unfolding, or attempting any “cleanup.”

Sources

https://www.disneytouristblog.com/collect-disneyana-tips/

https://www.parksavers.com/the-complete-guide-to-disneyana-collecting-tips-for-beginners-and-seasoned-fans/

https://www.invaluable.com/blog/disneyana/

https://www.antiquetrader.com/auctions/take-two-massive-disneyana-collection-hits-the-auction-block

https://www.carol-anne.ca/disneyana%20collectibles.htm

https://journalofantiques.com/digital-publications/joac-magazine/features/disney-100-years-of-wonder/

https://www.sideshow.com/brands/disney

https://blog.veve.me/post/rare-disney-collectibles-you-probably-didnt-know-existed

https://www.disneystore.com/collectibles/