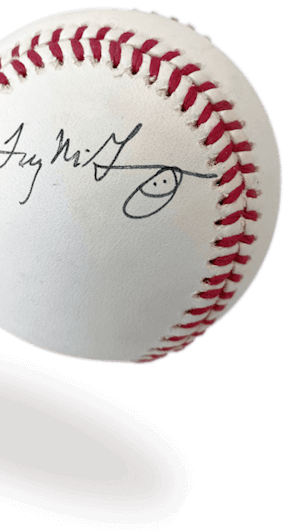

If you collect it, we can help protect it.

Protecting collectibles for more than 50 years To talk with an agent please call us at 888-837-9537 8:30am – 5:00pm ET, Monday – Friday.

Protecting collectibles for more than 50 years

If you collect it, we can help protect it

The fact is, most people don’t think about insurance until they need it. And while homeowners insurance is okay for everyday, easily replaced personal property, it usually doesn’t go far enough to cover those prized possessions you may have spent a lifetime collecting.

Like most collectors, we’re specialists. Providing collectible insurance is all we do. So, we’re able to passionately focus on servicing the needs of collectors like you. In fact, we never stop thinking of better ways to serve you.

Typically, if you can collect it, we can help insure it. And we’ve been providing a full range of protection for collections of all kinds for more than 50 years. So, protect your investment in minutes with no fuss, affordable coverage and get back to what you enjoy doing most – finding that next prized collectible to add to your collection.

Here are some of the features of the policy:

Comprehensive coverage

- Accidental Breakage

- Burglary

- Fire

- Flood (not available in FL; or A and V zones in other states)

- Loss in the Mail

- Natural Disasters

- Theft

- Other causes of loss, unless specifically excluded from the policy (see exclusions)

No serial numbers required

You do not need to provide serial numbers in order to insure your collection.

Coverage at home and away

- Travel – Transit coverage protects collectible property that is temporarily away from the scheduled location, subject to the policy sublimit.

- Exhibitions – If you’re at a scheduled exhibition, show or display coverage is provided for your collection up to the policy limit – including travel and shipping to and from the event.

- Storage Facilities – For an additional premium, we offer optional insurance coverage for collectibles kept in a public storage facility.

More affordable rates

Typically, you will pay less than it would cost to schedule the same items under a homeowners policy.

Less paperwork and red tape

Unlike homeowners insurance, we do not require a schedule or appraisal for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). The only exceptions are individual items or sets valued over $25,000 apiece, which would have to be scheduled.

We’re proven and trusted

We have been protecting collections like yours since 1966. And all coverage is provided by a carrier with a group rating of “A” (Excellent) by AM Best – the leading rating agency for the insurance industry.

Deductibles starting at $0

Deductibles start at $0 for collector policies. We provide coverage for the market value of your collection for losses in excess of $50. All dealer policies have a $500 deductible.

Insurance that grows with your collectibles

Collections tend to grow, so your policy can be adjusted to include any additions to your collection.

Inflation coverage

You may select “Automatic Monthly Increase” as optional coverage to be added to your policy for new acquisitions and appreciation of your existing collection. Selecting this coverage will apply an automatic monthly increase of 1% in coverage, up to a maximum of $1 million.

We provide coverage for dealers, too

If you want to protect your dealer inventory and your clients’ collections, for which you are responsible, we also offer special Dealers Insurance.

Superior customer service

Our company was started by collectors so it’s only natural that we would pay attention to your interests and needs. And that our customer service would always be geared to the collector’s point of view.

Prompt and personal claim service

As experienced specialists in collectibles, our adjusters understand their value and importance to you. That’s why, should you have a claim, they make every effort to make sure it is settled as quickly and completely as possible.