Resources

We’re here to help. If you have any questions, please call us toll-free Monday – Friday at 888-837-9537 (8:30a.m. – 5:00p.m. ET).

Links to appraisers

Tools, Forms & Brochures

Below you’ll find links to appraisers who can assist you in establishing a value to your collection and qualified inventory management sources. In addition, we have included all the applications and brochures you may need.

Valuation tools

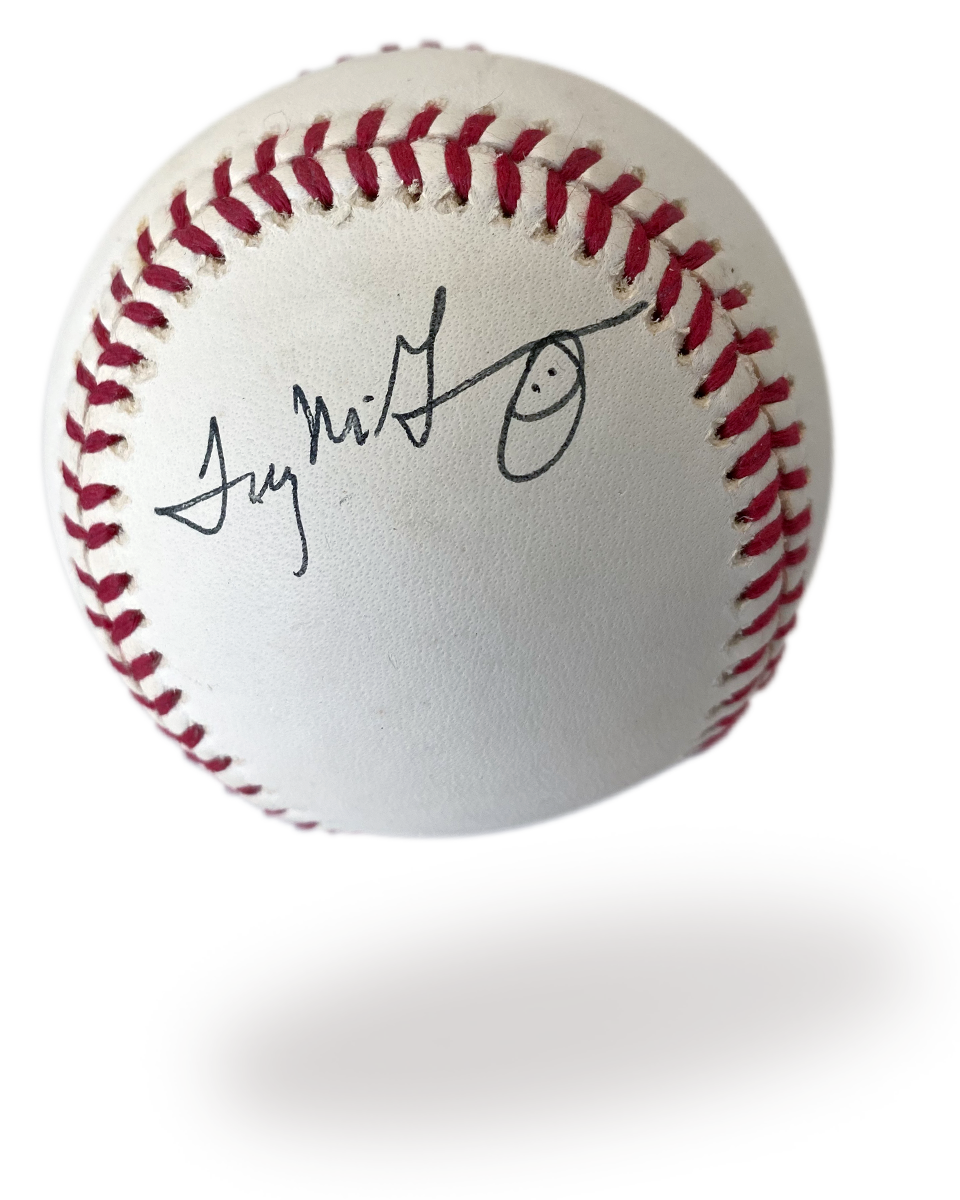

A collection—to the collector—is priceless. We understand that, but in the world of insurance, every collection has a value. If you want to get a valuation of your collection, we can help. Listed below are resources many collectors find helpful in establishing a value from individual items to entire collections.

Value My Stuff™ is an online appraisal company that has a team of experts, all of whom have worked for Sotheby’s, Christie’s or other leading auction houses. The company has specialists in more than 40 collecting categories. After you upload photographs and details of your item, Value My Stuff experts will email you within 48 hours a PDF report and online certificate detailing your item’s history and value.

Comic Book Collectors. Metropolis Collectibles offers a free appraisal service provided by nationally recognized experts in comic book evaluation. The retail value of your comic book is based on desirability, relative scarcity, and historical significance.

For comic book grading, Certified Guaranty Company® (CGC®) is a leading third-party grading service. Employing a team of 20+ professional graders, multiple experts will examine each collectible and assign a grade according to a well-established and internationally accepted standard. They offer free or paid annual memberships with many benefits. Check out what CGC membership has to offer.

Stamp Collectors. A good starting point is one of our former owners, Dan Walker, winner of the American Philatelic Society’s Champion of Champions Award and signatory of The Roll of Distinguished Philatelists. While not a certified appraiser, Dan knows the value of stamps and is a recognized expert in the field. If he is not familiar with your particular area of stamps, he knows who is and will direct you to that source. You can reach him at danforthwalker@comcast.net.

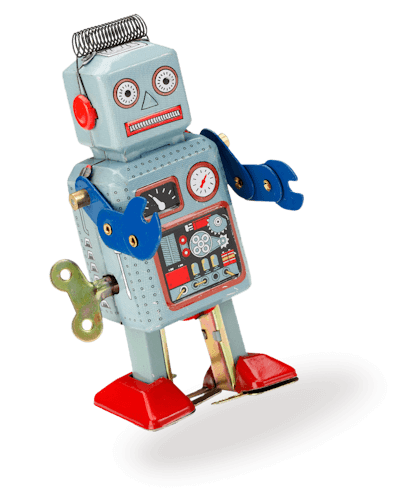

Collection management tools

Managing a collection can mystify some collectors. Here are a few resources we have found to be helpful and timesaving. Remember, having an inventory at the time of a claim helps you and the insurance carrier substantiate the value of the claim. When taking photos or video of your collection, be sure to capture any and all markings that authenticate the item. Keep a copy of your inventory in a secure, secondary location.

- Collectify™. Whether storing receipts and warranties, tracking auction prices or emailing reports, Collectify offers comprehensive cataloguing software.

- Capture My Assets™. Capture My Assets is a complete approach to documenting your collectibles, including an asset management system.

- Collector Systems. Collector Systems is a cloud-based collectibles management solution providing unlimited storage.

Forms & brochures

Below are our applications and helpful brochures. Click to access those you need. Completed applications may be emailed to info@collectinsure.com or faxed to 410-876-9233. If you have any questions, please call us toll-free Monday – Friday at 888-837-9537 (8:30a.m. – 5:00p.m. ET).

Applications

Collector Application

Collector Moving Application

Collector Scheduled Premises (Physical Location) Change Form

Collector Gold & Platinum Coin Application

Dealer Application

Dealer Incidental Coin Bullion & Jewelry Application

Dealer Scheduled Premises (Physical Location) Change Form