Protect your investment with specialty collectibles insurance.

Built for the investor collector.

Focusing on what matters to you

Investors

The fact is, most people don’t think about insurance until they need it. And while homeowners insurance is okay for everyday, easily replaced personal property, it usually doesn’t go far enough to cover those prized possessions you may have spent a lifetime collecting.

Like most collectors, we’re specialists. Providing collectible insurance is all we do. So, we’re able to passionately focus on servicing the needs of collectors like you. In fact, we never stop thinking of better ways to serve you.

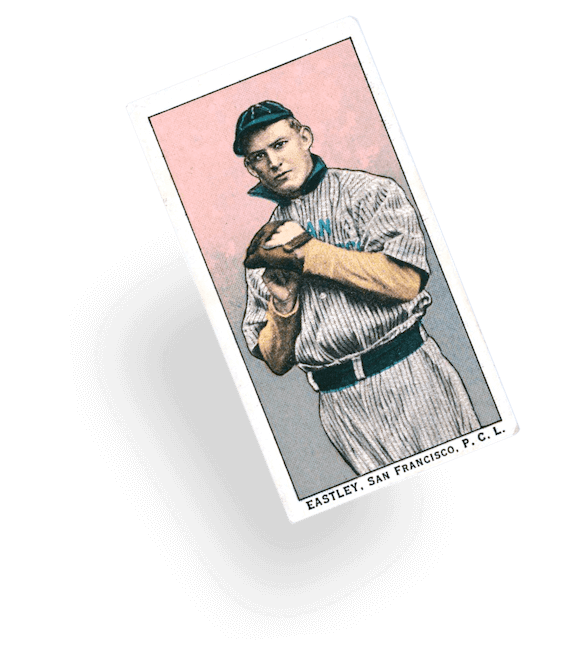

Typically, if you can collect it, we can help insure it. From beer cans to fine art, from baseball cards to moon dust, we’ve been providing a full range of protection for collections of all kinds for more than 50 years. Like most collectors, we’re specialists. Collectible insurance is all we do. So if you’re in the market for a little peace of mind when it comes to protecting your antique Colt revolver, your vintage automobilia and petroliana, or whatever else it is that you collect, check out this no fuss, affordable coverage. Then get back to what you enjoy doing most – finding that next prized item to add to your collection.

Here is a partial list of what we help insure. If you don’t see your collection, you can discuss with our expert Collectibles Insurance team by calling toll-free 888-837-9537.

- Advertising Collectibles

- Antique Radios/Phonographs

- Antique Tools

- Art (Comics, Animation, Lithographs, Prints)

- Bears/Steiff Collections

- Books & Manuscripts

- Club/Organization Memorabilia

- Coin Operated Devices

- Coins (except Gold & Platinum)

- Comics

- Dolls

- Entertainment Memorabilia

- Fine Art

- Furniture

- Glass/Pottery

- Guns/Knives/Other Arms & Accessories

- Hunting/Fishing

- Limited Edition Items

- Militaria

- Movie Props

- Musical Instruments

- Native American, including Arrowheads

- Paper/Ephemera

- Petroliana

- Political Memorabilia

- Records & CDs

- Sports Cards & Memorabilia

- Stamps & Philatelic Items*

- Toys/Action Figures

- Trains, including Layouts

- Video Games

- Vintage Clothing

- Vintage Sewing & Textiles

- Western Americana

- Writing Instruments

- Zippo Lighters

A schedule is required for individual items or sets valued over $25,000.

* Covered under separate policy.

Comprehensive coverage

- Accidental Breakage

- Burglary

- Fire

- Flood (except in Zones A & V)

- Loss in the Mail

- Natural Disasters

- Theft

- Other causes of loss, unless specifically excluded from the policy (see exclusions)

Coverage at home and away

- Travel – Transit coverage protects collectible property that is temporarily away from the scheduled location, subject to the policy sublimit.

- Exhibitions – If you’re at a scheduled exhibition, show or display coverage is provided for your collection up to the policy limit – including travel and shipping to and from the event.

- Storage Facilities – For an additional premium, we offer optional insurance coverage for collectibles kept in a public storage facility.

More affordable rates

Typically, you will pay less than it would cost to schedule the same items under a homeowners policy.

Less paperwork and red tape

Unlike homeowners insurance, we do not require a schedule or appraisal for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). The only exceptions are individual items or sets valued over $25,000 apiece, which would have to be scheduled.

We’re proven and trusted

We have been protecting collections like yours since 1966. And all coverage is provided by a carrier with a group rating of “A” (Excellent) by AM Best – the leading rating agency for the insurance industry.

Deductibles starting at $0

Deductibles start at $0 for collector policies. We provide coverage for the market value of your collection for losses in excess of $50. All dealer policies have a $200 deductible.

Insurance that grows with your collectibles

Collections tend to grow, so your policy can be adjusted to include any additions to your collection.

Inflation coverage

You may select “Automatic Monthly Increase” as optional coverage to be added to your policy for new acquisitions and appreciation of your existing collection. Selecting this coverage will apply an automatic monthly increase of 1% in coverage, up to a maximum of $1 million.

We provide coverage for dealers, too

If you want to protect your dealer inventory and your clients’ collections, for which you are responsible, we also offer special Dealers Insurance.

Superior customer service

Our company was started by collectors so it’s only natural that we would pay attention to your interests and needs. And that our customer service would always be geared to the collector’s point of view.

Prompt and personal claim service

As experienced specialists in collectibles, our adjusters understand their value and importance to you. That’s why, should you have a claim, they make every effort to make sure it is settled as quickly and completely as possible.

Frequently Asked Questions

CIS is a company founded by collectors, so we understand that your collection is often more of an emotional investment than a financial one and that each collection is worth far more to its owner than money alone. As experts in collectibles insurance, we have been protecting valued collections since 1966—offering not just coverage, but the kind of peace of mind that standard homeowners insurance simply cannot provide. Here’s just a few reasons why you should chose CIS to insure your valuable collectibles:

- Proven and Trusted – Protecting collections since 1966, all coverage is provided by a carrier with a group rating of “A” (Excellent) by A. M. Best, the leading rating agency for the insurance industry.

- Coverage at Home and Away – We provide coverage at any scheduled location in the United States. But, that’s not all. We provide transit coverage, which protects collectible property that is temporarily away from the scheduled location (subject to policy sublimit). If you’re at a scheduled exhibition, show or display, coverage is provided for your collection up to the policy limit—including travel and shipping to and from the event. We also provide optional insurance coverage for collectibles kept in a public storage facility (up to $100,000).

- Comprehensive Coverage – Coverage includes but is not limited to, accidental breakage, burglary, fire, flood (except in zones A & V), loss in the mail, theft, natural disasters, and other causes of loss unless specifically excluded from the policy.

- More Affordable Rates – Typically, you will pay less than it would cost to schedule the same items under a homeowners policy. Deductibles start at $0 for collector policies and we provide coverage for the market value of your collection for losses in excess of $50.

- Less Paperwork and Red Tape – Unlike Homeowners insurance, a schedule or appraisal is not required for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). Individual items or sets valued at $25,000 or more must be scheduled.

- It’s Fast and Easy – Get a quote online or call our expert CIS team at 888-837-9537 (8:30 am – 5:00 pm (EST), Monday – Friday).

Like most collectors, we’re specialists. Providing collectible insurance is all we do. So we’re able to passionately focus on servicing the needs of collectors like you. Generally, if you can collect it, we can insure it. (The list of what we provide coverage for is a lot longer than what we don’t.) Some of the most popular categories we insure include comics; guns, knives and accessories; sports cards and memorabilia; stamps and toys.

The following are excluded from our coverage: Government seizure or destruction of property; war and nuclear hazards; gradual deterioration such as fading, creasing or denting; nesting, infestation or discharge or release of waste products or secretions by insects, rodents or other animals; dampness or dryness of atmosphere; changes in or extremes of temperature other than fire; fraudulent, dishonest or criminal acts; voluntary parting with covered property; loss or damage while being worked on by you or others working on your behalf; and mysterious disappearance. This is not a complete list of exclusions and exclusions can vary by policy.

Collectibles Insurance Services was created by an avid stamp collector who realized that ordinary homeowners insurance simply couldn’t provide the coverage his rare treasures demanded. For everyday, easily replaced personal property, homeowners insurance is all most people need. But for prized possessions you may have spent a lifetime collecting, it doesn’t go nearly far enough. That’s why we offer a collection of benefits that less specialized insurance doesn’t often provide. For example:

- Homeowners coverage is typically based on the actual cash value of your collection—not its current market value.

- Homeowners can limit coverage of all the contents in your home to a percentage of your home’s total value (usually between 50% and 70%).

- It may not cover losses caused by floods, hurricanes, or earthquakes.

- Homeowners may have limited or no coverage for valuables like silver, guns, stamps, and other collectible items.

- You may be required to appraise and schedule all items individually. And new items must be reported and scheduled within 30 to 90 days of acquisition.

From moon dust to beer cans, we can help protect it.

Typically, if you can collect it,

we can help insure it.

Affordable coverage

Other Collections

Typically, if you can collect it, we can help insure it. From beer cans to fine art, from baseball cards to moon dust, we’ve been providing a full range of protection for collections of all kinds for more than 50 years. Like most collectors, we’re specialists. Collectible insurance is all we do. So if you’re in the market for a little peace of mind when it comes to protecting your antique Colt revolver, your vintage automobilia and petroliana, or whatever else it is that you collect, check out this no fuss, affordable coverage. Then get back to what you enjoy doing most – finding that next prized item to add to your collection.

Here is a partial list of what we help insure. If you don’t see your collection, you can discuss with our expert Collectibles Insurance team by calling toll-free 888-837-9537.

- Advertising Collectibles

- Antique Dealer Insurance

- Antique Radios/Phonographs

- Antique Tools

- Art Insurance

- Bears/Steiff Collections

- Books & Manuscripts

- Club/Organization Memorabilia

- Coin Operated Devices

- Coin Insurance (except Gold & Platinum)

- Comic Book Insurance

- Dolls

- Entertainment Memorabilia

- Fine Art

- Furniture

- Glass/Pottery

- Guns/Knives/Other Arms & Accessories

- Hunting/Fishing

- Limited Edition Items

- Militaria

- Movie Props

- Music Equipment Insurance

- Musical Instruments

- Native American, including Arrowheads

- Paper/Ephemera

- Petroliana

- Pokemon Insurance

- Political Memorabilia

- Records & CDs

- Sneaker Insurance

- Sports Card Insurance

- Insurance for Stamps

- Toy Insurance

- Trains, including Layouts

- Video Game Insurance

- Vintage Clothing

- Vintage Sewing & Textiles

- Western Americana

- Wine Insurance

- Writing Instruments

- Zippo Lighters

A schedule is required for individual items or sets valued over $25,000.

* Covered under separate policy.

Comprehensive coverage

- Accidental Breakage

- Burglary

- Fire

- Flood (except in Zones A & V)

- Loss in the Mail

- Natural Disasters

- Theft

- Other causes of loss, unless specifically excluded from the policy (see exclusions)

Coverage at home and away

- Travel – Transit coverage protects collectible property that is temporarily away from the scheduled location, subject to the policy sublimit.

- Exhibitions – If you’re at a scheduled exhibition, show or display coverage is provided for your collection up to the policy limit – including travel and shipping to and from the event.

- Storage Facilities – For an additional premium, we offer optional insurance coverage for collectibles kept in a public storage facility.

More affordable rates

Typically, you will pay less than it would cost to schedule the same items under a homeowners policy.

Less paperwork and red tape

Unlike homeowners insurance, we do not require a schedule or appraisal for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). The only exceptions are individual items or sets valued over $25,000 apiece, which would have to be scheduled.

We’re proven and trusted

We have been protecting collections like yours since 1966. And all coverage is provided by a carrier with a group rating of “A” (Excellent) by AM Best – the leading rating agency for the insurance industry.

Deductibles starting at $0

Deductibles start at $0 for collector policies. We provide coverage for the market value of your collection for losses in excess of $50. All dealer policies have a $200 deductible.

Insurance that grows with your collectibles

Collections tend to grow, so your policy can be adjusted to include any additions to your collection.

Inflation coverage

You may select “Automatic Monthly Increase” as optional coverage to be added to your policy for new acquisitions and appreciation of your existing collection. Selecting this coverage will apply an automatic monthly increase of 1% in coverage, up to a maximum of $1 million.

We provide coverage for dealers, too

If you want to protect your dealer inventory and your clients’ collections, for which you are responsible, we also offer special Dealers Insurance.

Superior customer service

Our company was started by collectors so it’s only natural that we would pay attention to your interests and needs. And that our customer service would always be geared to the collector’s point of view.

Prompt and personal claim service

As experienced specialists in collectibles, our adjusters understand their value and importance to you. That’s why, should you have a claim, they make every effort to make sure it is settled as quickly and completely as possible.

Frequently Asked Questions

CIS is a company founded by collectors, so we understand that your collection is often more of an emotional investment than a financial one and that each collection is worth far more to its owner than money alone. As experts in collectibles insurance, we have been protecting valued collections since 1966—offering not just coverage, but the kind of peace of mind that standard homeowners insurance simply cannot provide. Here’s just a few reasons why you should chose CIS to insure your valuable collectibles:

- Proven and Trusted – Protecting collections since 1966, all coverage is provided by a carrier with a group rating of “A” (Excellent) by A. M. Best, the leading rating agency for the insurance industry.

- Coverage at Home and Away – We provide coverage at any scheduled location in the United States. But, that’s not all. We provide transit coverage, which protects collectible property that is temporarily away from the scheduled location (subject to policy sublimit). If you’re at a scheduled exhibition, show or display, coverage is provided for your collection up to the policy limit—including travel and shipping to and from the event. We also provide optional insurance coverage for collectibles kept in a public storage facility (up to $100,000).

- Comprehensive Coverage – Coverage includes but is not limited to, accidental breakage, burglary, fire, flood (except in zones A & V), loss in the mail, theft, natural disasters, and other causes of loss unless specifically excluded from the policy.

- More Affordable Rates – Typically, you will pay less than it would cost to schedule the same items under a homeowners policy. Deductibles start at $0 for collector policies and we provide coverage for the market value of your collection for losses in excess of $50.

- Less Paperwork and Red Tape – Unlike Homeowners insurance, a schedule or appraisal is not required for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). Individual items or sets valued at $25,000 or more must be scheduled.

- It’s Fast and Easy – Get a quote online or call our expert CIS team at 888-837-9537 (8:30 am – 5:00 pm (EST), Monday – Friday).

Like most collectors, we’re specialists. Providing collectible insurance is all we do. So we’re able to passionately focus on servicing the needs of collectors like you. Generally, if you can collect it, we can insure it. (The list of what we provide coverage for is a lot longer than what we don’t.) Some of the most popular categories we insure include comics; guns, knives and accessories; sports cards and memorabilia; stamps and toys.

The following are excluded from our coverage: Government seizure or destruction of property; war and nuclear hazards; gradual deterioration such as fading, creasing or denting; nesting, infestation or discharge or release of waste products or secretions by insects, rodents or other animals; dampness or dryness of atmosphere; changes in or extremes of temperature other than fire; fraudulent, dishonest or criminal acts; voluntary parting with covered property; loss or damage while being worked on by you or others working on your behalf; and mysterious disappearance. This is not a complete list of exclusions and exclusions can vary by policy.

Collectibles Insurance Services was created by an avid stamp collector who realized that ordinary homeowners insurance simply couldn’t provide the coverage his rare treasures demanded. For everyday, easily replaced personal property, homeowners insurance is all most people need. But for prized possessions you may have spent a lifetime collecting, it doesn’t go nearly far enough. That’s why we offer a collection of benefits that less specialized insurance doesn’t often provide. For example:

- Homeowners coverage is typically based on the actual cash value of your collection—not its current market value.

- Homeowners can limit coverage of all the contents in your home to a percentage of your home’s total value (usually between 50% and 70%).

- It may not cover losses caused by floods, hurricanes, or earthquakes.

- Homeowners may have limited or no coverage for valuables like silver, guns, stamps, and other collectible items.

- You may be required to appraise and schedule all items individually. And new items must be reported and scheduled within 30 to 90 days of acquisition.

From the dilettante to the professional curator.

For one-of-a-kind collections. And

one-of-a-kind collectors.

Art Insurance

Art may be appreciated for its beauty, emotional power or creativity, but it also appreciates in value. That’s where Collectibles Insurance Services comes in – we provide art insurance coverage that gives you great peace of mind!

Whether your fine art collection consists of an oil on canvas, marble sculpture, artist’s proof giclée, or any other mediums, our decorative art and fine art insurance experts understand the uniqueness and the value of each piece in your collection. And because we value your collection as much as you do, we created a delightfully simple process that offers valuable features to insure your treasured art.

Comprehensive coverage

- Accidental Breakage

- Burglary

- Fire

- Flood (except in Zones A & V)

- Loss in the Mail

- Natural Disasters

- Theft

- Other causes of loss, unless specifically excluded from the policy (see exclusions)

Fine Art Insurance Coverage at Home and Away

- Travel – Transit coverage protects collectible property that is temporarily away from the scheduled location, subject to the policy sublimit.

- Exhibitions – If you’re at a scheduled exhibition, show, or display, coverage is provided for your collectibles up to the policy limit – including travel and shipping to and from the event.

- Storage Facilities – For an additional premium, we offer optional insurance coverage for collectibles kept in a public storage facility.

An Insurance Company With More Affordable Rates

Our fine art insurance policy offers affordable coverage! Typically, you will pay less than it would cost to schedule the same items under a homeowners coverage policy.

Less Paperwork and Red Tape

Unlike homeowners coverage, our fine art insurance coverage does not require a schedule or appraisal for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). The only exceptions are individual items or sets valued over $25,000 apiece, which would have to be scheduled.

We’re Proven and Trusted

Our fine art insurance policies are proven and trusted! We have been protecting collections like yours since 1966. And all coverage is provided by a carrier with a group rating of “A” (Excellent) by AM Best – the leading rating agency for the insurance industry.

Deductibles starting at $0

Deductibles start at $0 for collector policies. We provide coverage for the market value of your collectibles for losses in excess of $50. All dealer policies have a $200 deductible.

Insurance that grows with your collectibles

Collections tend to grow, so your fine art policy can be adjusted to include any additions to your collection.

Inflation coverage

You may select “Automatic Monthly Increase” as optional coverage to be added to your policy for new acquisitions and appreciation of your existing collection. Selecting this coverage will apply an automatic monthly increase of 1% in coverage, up to a maximum of $1 million.

We provide coverage for dealers, too

If you want to protect your dealer inventory and your clients’ private collections, for which you are responsible, we also offer special Dealers Insurance.

Superior customer service

Our company was started by collectors so it’s only natural that each insurance representative pays attention to your interests and needs. And that our customer service would always be geared to the collector’s point of view.

Prompt and personal claim service

As experienced specialists in collectibles, our adjusters understand their value and importance to you. That’s why, should you have a claim, they make every effort to make sure it is settled as quickly and completely as possible.

CIS Company Brochure

Want to learn more about the services we offer? Check out our collector brochure and our dealer brochure.

Related Services

We don’t just offer art insurance! We help provide coverage for collectibles of all kinds. The list of what we cover is longer than our list of what we don’t.

Get A Quote

Getting a quote is fast and easy! If you’re interested in getting art insurance, be sure to get a quote today.

Frequently Asked Questions

Yes, we offer insurance coverage for your fine art collection! Art may be appreciated for beauty, emotional power or creativity, but it also appreciates in value. That’s where CIS comes in. Whether your fine art collection is an oil on canvas, marble sculpture, artist’s proof giclée, or any other mediums, the decorative art and fine art experts in our insurance company understand the uniqueness of each collection. We have experience insuring collectors of all artistic creations who appreciate the scope and special coverage.

CIS is a company founded by collectors, so we understand that your collection is often more of an emotional investment than a financial one and that these collections are worth far more to its owner than money alone. As experts in collectibles insurance, we have been protecting valued collections since 1966—offering not just coverage, but the kind of peace of mind that standard homeowners coverage simply cannot provide. Here’s just a few reasons why you should chose CIS to provide insurance for your valuable collectibles:

- Proven and Trusted – Protecting fine art collectors and more since 1966, all coverage is provided by a carrier with a group rating of “A” (Excellent) by AM Best, the leading rating agency for the insurance industry.

- Coverage at Home and Away – We provide fine arts insurance coverage at any scheduled location in the United States. But, that’s not all. We provide transit coverage, which protects collectible property that is temporarily away from the scheduled location (subject to policy sublimit). If you’re at a scheduled exhibition, show, or display, coverage is provided for your collectibles up to the policy limit—including travel and shipping to and from the event. We also provide optional insurance coverage for art and collectibles kept in a public storage facility (up to $100,000).

- Comprehensive Coverage – Coverage includes but is not limited to, accidental breakage, burglary, fire, flood (except in zones A & V), loss in the mail, theft, natural disasters, and other causes of loss unless specifically excluded from the insurance policy.

- More Affordable Rates – Typically, you will pay less than it would cost to schedule the same items under your homeowners policy. Deductibles start at $0 for collector policies and we provide coverage for the market value of your collectibles for losses in excess of $50.

- Less Paperwork and Red Tape – Unlike homeowners coverage, a schedule or appraisal is not required for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). Individual items or sets valued at $25,000 or more must be scheduled.

- It’s Fast and Easy – Get a quote online or call our expert CIS team at 888-837-9537 (8:30 am – 5:00 pm (EST), Monday – Friday).

Collectibles Insurance Services was created by an avid stamp collector who realized that ordinary homeowners insurance simply couldn’t provide the coverage his rare treasures demanded. For everyday, easily replaced personal property, homeowners coverage is all most people need. But for prized possessions you may have spent a lifetime collecting, it doesn’t go nearly far enough. That’s why we offer a group of benefits that the less specialized insurance carrier doesn’t often provide. For example:

- Homeowners coverage is typically based on the actual cash value of your collectibles—not their current market value.

- Homeowners can limit coverage of all the contents in your home to a percentage of your home’s total value (usually between 50% and 70%).

- It may not cover losses caused by floods, hurricanes, or earthquakes.

- Homeowners may have limited or no coverage for valuables like silver, guns, stamps, and other collectible items.

- You may be required to appraise and schedule all items individually. And new items must be reported and scheduled within 30 to 90 days of acquisition.

Like most collectors, we’re specialists. Providing collectible insurance is all we do. So we’re able to passionately focus on servicing the needs of collectors like you. Generally, if you can collect it, we can insure it. (The list of what we provide coverage for is a lot longer than what we don’t.) Some of the most popular categories we cover include fine art insurance, comics, guns, knives and accessories; sports cards and memorabilia; stamps and toys.

The following are excluded from our coverage: Government seizure or destruction of property; war and nuclear hazards; gradual deterioration such as fading, creasing or denting; nesting, infestation or discharge or release of waste products or secretions by insects, rodents or other animals; dampness or dryness of atmosphere; changes in or extremes of temperature other than fire; fraudulent, dishonest or criminal acts; voluntary parting with covered property; loss or damage while being worked on by you or others working on your behalf; and mysterious disappearance. This is not a complete list of exclusions and exclusions can vary by policy.

Covering all your bases, so you can focus on the home run.

With a roster of dedicated professionals we provide the protection you deserve.

We understand the value of teamwork

Sports Memorabilia Insurance

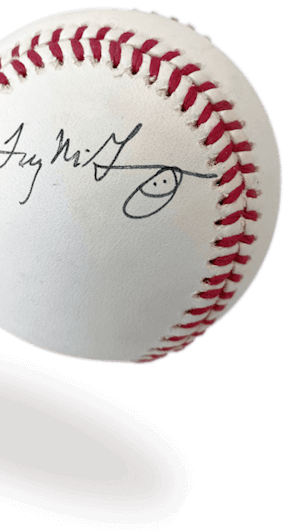

You don’t just collect sports memorabilia. That signed baseball, football jersey, or stadium seat represents a piece of sports history. Each item in your collection tells a story. And it’s your love of the game and its heroes that motivates you to hunt down that next prized item for your collection.

From such treasures as a Babe Ruth signed baseball, a Mickey Mantle rookie card or a Honus Wagner card to whole categories like Ted Williams memorabilia and World Series memorabilia, we’ve spent decades protecting these stories. We know how much you value your sports memorabilia collection. That’s why we provide equally valuable features in our collectibles insurance coverage.

Insurance for Trading Cards

Since their first appearance in packs of bubble gum and tobacco, trading cards have become a hot commodity. Whether you collect baseball, basketball, football, soccer, or another sport, we’ve got your back!

No matter the size of your collection, Collectibles Insurance Services is here to help. So you can relax and enjoy peace of mind while adding to your collection.

Comprehensive coverage for your sports memorabilia collection

- Accidental Breakage

- Burglary

- Fire

- Flood (except in Zones A & V)

- Loss in the Mail

- Natural Disasters

- Theft

- Other causes of loss, unless specifically excluded from the policy (see exclusions)

Coverage at home and away

- Travel – Transit coverage protects collectible property that is temporarily away from the scheduled location, subject to the policy sublimit.

- Exhibitions – If you’re at a scheduled exhibition, show or display coverage is provided for your collection up to the policy limit – including travel and shipping to and from the event.

- Storage Facilities – For an additional premium, we offer optional insurance coverage for collectibles kept in a public storage facility.

More affordable rates

Typically, you will pay less than it would cost to schedule the same sports memorabilia items under a homeowners policy.

Less paperwork and red tape

Unlike the average homeowners insurance company, we do not require a schedule or appraisal for most sports memorabilia items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). The only exceptions are individual items or sets valued over $25,000 apiece, which would have to be scheduled.

We’re proven and trusted

We have been protecting collections of sports memorabilia and more since 1966. And all coverage is provided by a carrier with a group rating of “A” (Excellent) by AM Best – the leading rating agency for the insurance industry.

Deductibles starting at $0

Deductibles start at $0 for collector policies. We provide coverage for the market value of your sports memorabilia collection for losses in excess of $50. All dealer policies have a $200 deductible.

Collectibles insurance that grows with your collection

Collections tend to grow, so your policy can be adjusted to include any additions to your collection.

Inflation coverage

You may select “Automatic Monthly Increase” as optional coverage to be added to your policy for new acquisitions and appreciation of your existing collection. Selecting this coverage will apply an automatic monthly increase of 1% in coverage, up to a maximum of $1 million.

We provide coverage for dealers, too

If you want to protect your dealer inventory and your clients’ sports memorabilia collections, for which you are responsible, we also offer special Dealers Insurance.

Superior customer service

Our company was started by collectors, so it’s only natural that we would pay attention to your interests and needs. And that our customer service would always be geared to the collector’s point of view.

Prompt and personal claim service

As experienced specialists in collectibles, our adjusters understand the value and importance of your sports memorabilia. That’s why, should you have a claim, they make every effort to make sure it is settled as quickly and completely as possible.

CIS Company Brochure

Want to learn more about the services we offer? Check out our collector brochure and our dealer brochure.

Related Services

We don’t just offer sports card insurance! We help provide coverage for collectibles of all kinds. The list of what we cover is longer than our list of what we don’t.

Get A Quote

Getting a quote is fast and easy! If you’re interested in getting sports card insurance, be sure to get a quote today.

Frequently Asked Questions

From such prized treasures as a Babe Ruth signed baseball, a Mickey Mantle rookie card or even a Honus Wagner card to whole categories like Ted Williams memorabilia and World Series memorabilia, the world of sports collectibles attracts fans of all kinds. We have insured card and sports collections of all sizes since 1996 (and stamps for nearly 50 years), so we know how much you value your collection of sports memorabilia. That’s why we provide equally valuable features in our coverage.

CIS is a company founded by collectors, so we understand that your collection is often more of an emotional investment than a financial one and that each collection is worth far more to its owner than money alone. As experts in collectibles insurance, we have been protecting valued collections of sports memorabilia and more since 1966—offering not just coverage, but the kind of peace of mind that standard homeowners insurance company simply cannot provide. Here’s just a few reasons why you should chose CIS to insure your valuable collectibles:

- Proven and Trusted – Protecting collections since 1966, all coverage is provided by a carrier with a group rating of “A” (Excellent) by A. M. Best, the leading rating agency for the insurance industry.

- Coverage at Home and Away – We provide sports memorabilia insurance coverage at any scheduled location in the United States. But, that’s not all. We provide transit coverage, which protects collectible property that is temporarily away from the scheduled location (subject to policy sublimit). If you’re at a scheduled exhibition, show, or display, coverage is provided for your collection up to the policy limit—including travel and shipping to and from the event. We also provide optional insurance coverage for collectibles kept in a public storage facility (up to $100,000).

- Comprehensive Coverage – Coverage includes but is not limited to, accidental breakage, burglary, fire, flood (except in zones A & V), loss in the mail, theft, natural disasters, and other causes of loss unless specifically excluded from the policy.

- More Affordable Rates – Typically, you will pay less than it would cost to schedule the same items under a homeowners policy. Deductibles start at $0 for collector policies and we provide coverage for the market value of your collection for losses in excess of $50.

- Less Paperwork and Red Tape – Unlike homeowners insurance, a schedule or appraisal is not required for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). Individual items or sets valued at $25,000 or more must be scheduled.

- It’s Fast and Easy – Get a quote online or call our expert CIS team at 888-837-9537 (8:30 am – 5:00 pm (EST), Monday – Friday).

Collectibles Insurance Services was created by an avid stamp collector who realized that ordinary homeowners insurance simply couldn’t provide the coverage his rare treasures demanded. For everyday, easily replaced personal property, homeowners insurance is all most people need. But for prized possessions you may have spent a lifetime collecting, it doesn’t go nearly far enough. That’s why we offer a collection of benefits that less specialized insurance doesn’t often provide. For example:

- Homeowners coverage is typically based on the actual cash value of your collection—not its current market value.

- Homeowners can limit coverage of all the contents in your home to a percentage of your home’s total value (usually between 50% and 70%).

- It may not cover losses caused by floods, hurricanes, or earthquakes.

- Homeowners may have limited or no coverage for valuables like silver, guns, stamps, and other collectible items.

- You may be required to appraise and schedule all items individually. And new items must be reported and scheduled within 30 to 90 days of acquisition.

Like most collectors, we’re specialists. Providing collectible insurance is all we do. So we’re able to passionately focus on servicing the needs of sports memorabilia collectors like you. Generally, if you can collect it, we can insure it. (The list of what we provide coverage for is a lot longer than what we don’t.) Some of the most popular categories we insure include comics; guns, knives and accessories; sports cards and memorabilia; stamps and toys.

The following are excluded from our coverage: Government seizure or destruction of property; war and nuclear hazards; gradual deterioration such as fading, creasing or denting; nesting, infestation or discharge or release of waste products or secretions by insects, rodents or other animals; dampness or dryness of atmosphere; changes in or extremes of temperature other than fire; fraudulent, dishonest or criminal acts; voluntary parting with covered property; loss or damage while being worked on by you or others working on your behalf; and mysterious disappearance. This is not a complete list of exclusions and exclusions can vary by policy.

We got your back so you can do superhero stuff.

Assembling your collection is half the fun. We provide coverage that stretches to meet your needs.

Superhero protection

Comic Book Collection Insurance

It’s the hero at the center of the story that inspires you to collect your comic books. We get it. Collectibles Insurance Services was founded by collectors, for collectors. It’s all we do. In fact, you might say that we’re the superheroes of specialized comic book insurance for a comic book collection of any size.

But while securing that prized Golden, Silver, Bronze Age or Modern comic book likely took significant time, energy and money, your insurance to protect it shouldn’t. That’s why our process is fast and easy and coverage is comprehensive and affordable. So you can get back to doing what you enjoy most – finding that next prized comic book to add to your collection.

Comprehensive coverage

- Accidental Breakage

- Burglary

- Fire

- Flood (except in Zones A & V)

- Loss in the Mail

- Natural Disasters

- Theft

- Other causes of loss, unless specifically excluded from the policy (see exclusions)

Coverage at home and away

- Travel – Transit coverage protects collectible property that is temporarily away from the scheduled location, subject to the policy sublimit.

- Exhibitions – If you’re at a scheduled exhibition, show or display coverage is provided for your collection up to the policy limit – including travel and shipping to and from the event.

- Storage Facilities – For an additional premium, we offer optional insurance coverage for collectibles kept in a public storage facility.

More affordable rates

Typically, you will pay less than it would cost to schedule the same items under a homeowners policy.

Less paperwork and red tape

Unlike the average homeowners insurance company, we do not require a schedule or appraisal for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). The only exceptions are individual items or sets valued over $25,000 apiece, which would have to be scheduled.

We’re proven and trusted

We have been protecting collections like yours since 1966. And all coverage is provided by a carrier with a group rating of “A” (Excellent) by AM Best – the leading rating agency for the insurance industry.

Deductibles starting at $0

Deductibles start at $0 for collector policies that cover comic books. We provide coverage for the market value of your collection for losses in excess of $50. All dealer policies have a $200 deductible.

Insurance that grows with your collectibles

Collections tend to grow, so your comic book collection insurance policy can be adjusted to include any additions to your comic book collection.

Inflation coverage

You may select “Automatic Monthly Increase” as optional coverage to be added to your policy for new acquisitions and appreciation of your existing comic book collection. Selecting this coverage will apply a monthly automatic coverage increase of 1% in coverage, up to a maximum of $1 million.

We provide coverage for dealers, too

If you want to protect your dealer inventory and your clients’ collections of comic books, for which you are responsible, we also offer special Dealers Insurance.

Superior customer service

Our company was started by collectors, so it’s only natural that we would pay attention to your interests and needs when it comes to comic book insurance. And that our customer service would always be geared to the collector’s point of view.

Prompt and personal claim service

As experienced specialists in collectibles, our adjusters understand the value and importance of your comic books to you. That’s why, should you have a claim, they make every effort to make sure it is settled as quickly and completely as possible.

Frequently Asked Questions

From Golden Age comics (including Batman No. 1 and Superman No. 1) to Silver Age comics and Bronze Age comics, comic books are among the most enjoyable collectibles around. We have insured collections of all sizes since 1996 (and stamps for nearly 50 years), so we know how much you value your collection of comic books. That’s why we provide equally valuable features in our coverage.

If you’re a comic book collector, you may want to check out Dreck Check. Designed with the serious collector in mind, Dreck Check is a comic book search engine for collectors and dealers. This free search engine provides real-time price guides based on the most up-to-date auction information found across the web. Another for valuation is Metropolis Collectibles. This site offers a free appraisal service provided by nationally recognized experts in comic book evaluation. The retail value of your comic books is based on their desirability, relative scarcity, and historical significance. For comic book grading, Certified Guaranty Company® (CGC®) is a leading third-party grading service. Employing a team of 20+ professional graders, multiple experts will examine each collectible and assign a grade according to a well-established and internationally accepted standard. They offer free or paid annual memberships with many benefits. Check out what CGC membership has to offer.

CIS is a company founded by collectors, so we understand that your collection is often more of an emotional investment than a financial one and that each collection is worth far more to its owner than money alone. As experts in collectibles insurance, we have been protecting valued collections since 1966—offering not just coverage, but the kind of peace of mind that standard homeowners insurance simply cannot provide. Here’s just a few reasons why you should chose CIS to insure your valuable collectibles:

- Proven and Trusted – Protecting collections since 1966, all coverage is provided by a carrier with a group rating of “A” (Excellent) by A. M. Best, the leading rating agency for the insurance industry.

- Coverage at Home and Away – We provide coverage at any scheduled location in the United States. But, that’s not all. We provide transit coverage, which protects collectible property that is temporarily away from the scheduled location (subject to policy sublimit). If you’re at a scheduled exhibition, show or display, coverage is provided for your collection up to the policy limit—including travel and shipping to and from the event. We also provide optional insuran

CIS is a company founded by collectors, so we understand that your extensive collection is often more of an emotional investment than a financial one and that each collection is worth far more to its owner than money alone. As experts in collectibles insurance, we have been protecting valued collections since 1966—offering not just coverage, but the kind of peace of mind that standard homeowners insurance company simply cannot provide. Here’s just a few reasons why you should choose CIS to insure your valuable comic book collection:

- Proven and Trusted – Protecting collections since 1966, all coverage is provided by a carrier with a group rating of “A” (Excellent) by AM Best, the leading rating agency for the insurance industry.

- Coverage at Home and Away – We provide coverage at any scheduled location in the United States. But, that’s not all. We provide transit coverage, which protects collectible property that is temporarily away from the scheduled location (subject to policy sublimit). If you’re at a scheduled exhibition, show, or display, coverage is provided for your collection up to the policy limit—including travel and shipping to and from the event. We also provide optional insurance coverage for collectibles kept in a public storage facility (up to $100,000).

- Comprehensive Coverage – Coverage includes but is not limited to, accidental breakage, burglary, fire, flood (except in zones A & V), loss in the mail, theft, natural disasters, and other causes of loss unless specifically excluded from the policy.

- More Affordable Rates – Typically, you will pay less than it would cost to schedule the same items under a homeowners policy. Deductibles start at $0 for collector policies and we provide coverage for the full market value of your collection for losses in excess of $50.

- Less Paperwork and Red Tape – Unlike the typical homeowners insurance company, a schedule or appraisal is not required for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). Individual items or sets valued at $25,000 or more must be scheduled.

- It’s Fast and Easy – Get a quote online or call our expert CIS team at 888-837-9537 (8:30 am – 5:00 pm (EST), Monday – Friday).

- Comprehensive Coverage – Coverage includes but is not limited to, accidental breakage, burglary, fire, flood (except in zones A & V), loss in the mail, theft, natural disasters, and other causes of loss unless specifically excluded from the policy.

- More Affordable Rates – Typically, you will pay less than it would cost to schedule the same items under a homeowners policy. Deductibles start at $0 for collector policies and we provide coverage for the market value of your collection for losses in excess of $50.

- Less Paperwork and Red Tape – Unlike Homeowners insurance, a schedule or appraisal is not required for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). Individual items or sets valued at $25,000 or more must be scheduled.

- It’s Fast and Easy – Get a quote online or call our expert CIS team at 888-837-9537 (8:30 am – 5:00 pm (EST), Monday – Friday).

Collectibles Insurance Services was created by an avid stamp collector who realized that ordinary homeowners insurance simply couldn’t provide the coverage his rare treasures demanded. For everyday, easily replaced personal property, homeowners insurance is all most people need. But for prized possessions you may have spent a lifetime collecting, it doesn’t go nearly far enough. That’s why we offer a collection of benefits that less specialized insurance doesn’t often provide. For example:

Collectibles Insurance Services was created by an avid stamp collector who realized that an ordinary homeowners insurance policy simply couldn’t provide the coverage his rare treasures demanded. For everyday, easily replaced personal property, a homeowners insurance policy is all most people need. But for prized possessions you may have spent a lifetime collecting, it doesn’t go nearly far enough. That’s why we offer a collection of benefits that the less specialized insurance company doesn’t often provide. For example:

- Homeowners coverage is typically based on the actual cash value of your collection—not its current market value.

- A homeowners insurance policy can limit coverage of all the contents in your home to a percentage of your home’s total value (usually between 50% and 70%).

- It may not cover losses caused by floods, hurricanes, or earthquakes.

- A homeowners insurance policy may have limited or no coverage for valuables like silver, guns, stamps, and other collectible items.

- You may be required to appraise and schedule all items individually. And new items must be reported and scheduled within 30 to 90 days of acquisition.

Like most collectors, we’re specialists. Providing collectible insurance is all we do. So we’re able to passionately focus on servicing the needs of comic book collectors like you. Generally, if you can collect it, we can insure it. (The list of what we cover is a lot longer than what we don’t.) Some of the most popular categories we insure include comics; guns, knives and accessories; sports cards and memorabilia; stamps and toys.

The following are excluded from our coverage: Government seizure or destruction of property; war and nuclear hazards; gradual deterioration such as fading, creasing or denting; nesting, infestation or discharge or release of waste products or secretions by insects, rodents or other animals; dampness or dryness of atmosphere; changes in or extremes of temperature other than fire; fraudulent, dishonest or criminal acts; voluntary parting with covered property; loss or damage while being worked on by you or others working on your behalf; and mysterious disappearance. This is not a complete list of exclusions and exclusions can vary by policy.

If you collect it, we can help protect it.

Protecting collectibles for more than 50 years To talk with an agent please call us at 888-837-9537 8:30am – 5:00pm ET, Monday – Friday.

Protecting collectibles for more than 50 years

If you collect it, we can help protect it

The fact is, most people don’t think about insurance until they need it. And while homeowners insurance is okay for everyday, easily replaced personal property, it usually doesn’t go far enough to cover those prized possessions you may have spent a lifetime collecting.

Like most collectors, we’re specialists. Providing collectible insurance is all we do. So, we’re able to passionately focus on servicing the needs of collectors like you. In fact, we never stop thinking of better ways to serve you.

Typically, if you can collect it, we can help insure it. And we’ve been providing a full range of protection for collections of all kinds for more than 50 years. So, protect your investment in minutes with no fuss, affordable coverage and get back to what you enjoy doing most – finding that next prized collectible to add to your collection.

Here are some of the features of the policy:

Comprehensive coverage

- Accidental Breakage

- Burglary

- Fire

- Flood (except in Zones A & V)

- Loss in the Mail

- Natural Disasters

- Theft

- Other causes of loss, unless specifically excluded from the policy (see exclusions)

No serial numbers required

You do not need to provide serial numbers in order to insure your collection.

Coverage at home and away

- Travel – Transit coverage protects collectible property that is temporarily away from the scheduled location, subject to the policy sublimit.

- Exhibitions – If you’re at a scheduled exhibition, show or display coverage is provided for your collection up to the policy limit – including travel and shipping to and from the event.

- Storage Facilities – For an additional premium, we offer optional insurance coverage for collectibles kept in a public storage facility.

More affordable rates

Typically, you will pay less than it would cost to schedule the same items under a homeowners policy.

Less paperwork and red tape

Unlike homeowners insurance, we do not require a schedule or appraisal for most items; however, you are responsible for maintaining your own inventory for insurance purposes (in the event of loss). The only exceptions are individual items or sets valued over $25,000 apiece, which would have to be scheduled.

We’re proven and trusted

We have been protecting collections like yours since 1966. And all coverage is provided by a carrier with a group rating of “A” (Excellent) by AM Best – the leading rating agency for the insurance industry.

Deductibles starting at $0

Deductibles start at $0 for collector policies. We provide coverage for the market value of your collection for losses in excess of $50. All dealer policies have a $500 deductible.

Insurance that grows with your collectibles

Collections tend to grow, so your policy can be adjusted to include any additions to your collection.

Inflation coverage

You may select “Automatic Monthly Increase” as optional coverage to be added to your policy for new acquisitions and appreciation of your existing collection. Selecting this coverage will apply an automatic monthly increase of 1% in coverage, up to a maximum of $1 million.

We provide coverage for dealers, too

If you want to protect your dealer inventory and your clients’ collections, for which you are responsible, we also offer special Dealers Insurance.

Superior customer service

Our company was started by collectors so it’s only natural that we would pay attention to your interests and needs. And that our customer service would always be geared to the collector’s point of view.

Prompt and personal claim service

As experienced specialists in collectibles, our adjusters understand their value and importance to you. That’s why, should you have a claim, they make every effort to make sure it is settled as quickly and completely as possible.

“My wife says I have a disease!” says Timothy Wagner of his still-growing collection of over 700 diecast cars. This large collection stems from a genuine passion for real vehicles. Many of the cars in Tim’s collection are based on real-life vehicles that have special meaning to him.

The first car in Tim’s collection was a red 1956 Chrysler New Yorker. This was the same car that his grandparents owned when he was a teenager – a car in which he drove his grandfather to the hospital when he was just 15 years old. Tim loved this car, but, “My mother had the audacity to tell me I was too young to have a car, and so she sold it for $300,” shares Tim. “I cried!”

Tim is a collector of mostly Chrysler products, as well as Plymouths, Dodges, and some racecars. His most prized car is a 1967 Plymouth Belvedere Sox and Martin car signed by racecar driver Ronnie Sox. “I was into drag racing as a kid,” he shares. Another prized possession is a 1968 Roadrunner model, of which he owns both the model and a real full-size car. “I’ve had this car for 35 years, and I love it!” He also has a 1965 Ford Galaxy model that a friend is helping him change to a convertible. His mom owned a 1965 Ford Galaxy 500 convertible for 14 years when he was a kid.

Tim’s collection has grown in value. He purchased many of his model cars for under $50, and now they are worth well into the $200 range. “All my Sox and Martin cars were bought for under $100, and they are now worth over $200.” He has a whole collection of just 1/18 scale diecast cars valued at $25,000.

Tim has become interested in collecting diorama figurines to go with the diecast cars. “They are plastic figurines called Diorama Classics. They help set up the scenery for the cars in my collection!” He has a glass case with about five cars in it, and they are the cars that he stages with the figurines.

Most of his cars are on display in Tim’s family room, which his family refers to as the “toy room.” He built wooden shelving on which to store the cars and is in the process of lighting them. The cars are sorted by type – Plymouth, Dodge, Chrysler – and then there is a section with trucks and a few other odd items that defy categorization. “My daughter and my son always give me diecast for Christmas and birthdays, so I end up with a lot more of them. They just keep growing!” In addition to the cars, Tim’s “toy room” also has a track with a Lionel train that runs around it.

Tim’s collection has become an outlet for his love of cars. “It gives me the chance to have [model-versions of] the cars that I would’ve loved to have but couldn’t,” shares Tim. “I’ve had over 290 full-size cars, but now I’m down to just seven full-size cars and two trucks. My wife says I’ve got enough!”

Collectibles Insurance Services was founded by collectors, for collectors! Homeowners insurance often falls short when it comes to providing coverage for collections, so that’s where we step in. We help insure collections of all kinds — from LEGOs to sports memorabilia, and comic books to toys, and so much more.

Find out what types of collections we insure or get a quote today!

Some collections are more than what they seem at face value, and this is true of Ken Florey’s collection of women’s suffrage memorabilia. Ken is drawn to collecting such items because of the story that unfolds with each piece. His collection is the largest accumulation of women’s suffrage memorabilia gathered by a private collector, and it consists of items such as posters, buttons, china, prisoner’s medals, postcards, sashes, pennants, sheet music, and more.

Ken’s interest in collecting such items was sparked in the 1980s, when he was the Vice President of the Ephemera Society of America, which has a conference every year. At the time, there was a periodical called AB Booklist, a trade publication for antique book dealers. Every year, an issue would be published in conjunction with the annual convention. One year, they wanted to do a special issue on women, and Ken was asked to do an article on women’s suffrage.

Ken had a friend with an extensive collection, so he used this as a source for the article. “I became so attracted to the items and the stories behind them,” shares Ken. He began to collect for himself, focusing on buttons, sashes, and ribbons. As his collection grew, so did his definition of memorabilia. Today, he has about 4,500 different items in his collection. Besides his passion for the history behind each object, Ken also loves the connections that develop from collecting. “I formed some lifelong friendships,” he says. “My collection is more than just collecting objects. It’s getting in touch with other people, it’s forming friendships.”

Ken considers himself to be a collector since childhood. “There are two kinds of people in the world: collectors and non-collectors. When I was a kid I collected comic books, stamps – all kinds of things. As I grew older, my toys changed.” Before he got into suffrage, he was collecting political items and buttons. He has since sold these political collectibles to focus solely on suffrage. His collection dates back to the 1850s, with most of the buttons and ribbons dating from the end of the 19th century to the early 20th. In America, most of the objects were produced from 1907 or 1908 to about 1917.

Ken’s favorite piece from his collection is an item called a hunger strike medal. “It’s a medal that was given in England to women who underwent hunger strikes in prison and were force fed,” explains Ken. “There are only about 100 of these medals. Each medal hangs from a ribbon and on the back has a name.” Lavander Guthrie is on the back of Ken’s medal. Research revealed that Guthrie was not a major participant in the suffrage movement. When she got out of prison she was given this medal and then dropped out of the movement and then sought out a means to make a living for herself, including becoming an actress under the name “Laura Grey.” The medal, “is the most prized piece in my collection,” Ken says.

Another portion of the collection that Ken values is some special china that came from a very wealthy socialite named Mrs. Alva Belmont, who bankrolled much of the suffrage movement. “In 1913 she held the famous Council of Great Women Conference at her estate,” Ken explains. “She had ordered from England a complete set of china for this meeting. She also used the china in a lunchroom that she ran. To have these pieces is just wonderful!”

Ken also has a small cardboard poster that advertises a meeting in Connecticut. The poster shows some of the local suffragists and one of the photos on the poster is a woman with several of her children. The woman is Katharine Hepburn, the mother of the actress, and one of the children pictured is the actress herself. He also has a paper invitation, dated 1870, inviting people to a meeting to form the American Women’s Suffrage Association. Julia Ward Howe, who wrote “The Battle Hymn of the Republic,” was an ardent suffragette, and she composed a personal, penciled note on the back of this invitation to a “Mr. Weiss,” asking him to attend. Finally, another notable item is a 19th century ribbon autographed by Susan B. Anthony.

Collectibles Insurance Services was founded by collectors, for collectors! Homeowners insurance often falls short when it comes to providing coverage for collections, so that’s where we step in. We help insure collections of all kinds — from LEGOs to sports memorabilia, and comic books to toys, and so much more.

Find out what types of collections we insure or get a quote today!

The first movie that Matt Sherman remembers seeing was the James Bond movie, The Spy Who Loved Me, in 1977. He soon discovered paperback James Bond novels in a store and began to collect them. Over 100,000,000 copies of these books have been sold, and they have been printed in over 20 languages. Eventually, he got tired of waiting for new books to come out, so he sold some of his books to invest in movie props. Getting props from the earlier films was challenging, as these movies were released before the days when a prop from popular film would be auctioned off for big bucks. People weren’t yet thinking of props as collectibles!

With the ability to find auctions on the internet, Matt began to collect other Bond items. Today, this collection is modestly sized, containing about 300 items total. “There are two kinds of collectors,” Matt explains. Some collect everything they can get their hands on. Others will buy, sell, and trade to get better items. Matt is the latter. “Most of my items are genuine props from the films.”

Over half the world’s population has seen a Bond movie. There have been 26 James Bond films released since 1962, with the 27th, No Time to Die, coming in October. Matt has props from 18 of these movies. The most coveted are the “screen-seen” props, which appeared on camera. Matt’s first purchase involved the vehicles that appear in the films. “At the Ian Fleming Foundation, they curate and restore actual vehicles. As a fundraiser, they would mount and frame parts of the James Bond vehicles.”

These days, Matt’s main collecting emphasis has been Bond casino items. “I have over 200 plaques and chips from Bond casinos and films,” he shares. These are screen-used plaques, which were a bit costly because they are difficult to find. The most valuable item is a plaque from the 1999 Bond film The World Is Not Enough, starring Pierce Brosnan. This was the central plaque on the head table when they played $1 million on one high card draw. Its value is at least five figures. “Bond collecting is like collecting from the Star Wars films,” shares Matt. “There’s a lot to collect. [There are] clothes, posters, props, perfumes, colognes, and makeup. There are still bargains to be found. I occasionally find a genuine prop for $30 or $40.” The most he has spent on a single purchase is about $5,000.

Matt finds it difficult to name a favorite item from the collection. “For me, it’s like choosing my favorite child!” Still, there are a few standout items. “I have a letter from her majesty Queen Elizabeth. I wrote to her, and she sent me a reply and she acknowledged my fandom.” Die Another Day had an ice motif, and the villain had a palace of ice and an ice motel. Matt has an ice gun from this movie, one of a limited number made for the lead actors and film producers. “I also appreciate my Casino Royale plaques,” he shares. “They were made by the casino company that made all the casino plaques for the last century, and this was the only non-casino plaque they made.”

Everything from this collection is on display in Matt’s home. “One of the reasons I reduced the number of collectibles I had is that I wanted them all on display – not boxed up.” He’s also not concerned about touching and handling the items. “I have glass shelves, and everything is out for display. I allow friends to handle them. They are accessible and within easy reach.” He also has different shelves for different Bond actors, such as Daniel Craig and Pierce Brosnan, and all the casino items are grouped together. He has a holding case of at least 100 different poker chips so that people can see them all in one case.

Bond collectors are a small group compared to collectors of other movie props – such as Star Wars and Star Trek. This creates a community where everyone knows each other and shares collectibles. “My wife and I have been running James Bond fan conventions for about twenty years,” says Matt. This includes fan tours, where people are taken directly to film locations. Unlike Star Wars and Star Trek, Bond movies were often filmed on-location rather than in the studio. Collectors will often return from these tours with pieces of a vehicle or other items from the location. “Fans delight in finding things on location – it’s a piece of movie history that you got to have by visiting the site,” shares Matt. “It’s very unique to James Bond.”

When asked about his favorite Bond actor, Matt explains that his opinion aligns with that of many other fans. “Sean Connery was a terrific actor, and if he hadn’t done the first films they would not be doing them years later.” But he also enjoys actor Timothy Dalton. “Timothy Dalton read the books and looked like the character, and he tried to bring that to his portrayal.” Overall, he believes that Sean Connery was the best for introducing Bond to the world, while Timothy Dalton was most like the Bond of the books.

Matt’s collection is the biggest and best Bond casino collection because of the effort he has put into pursuing collectibles from around the world. In addition to collecting, Matt has several books in print, including James Bond’s Cuisine: 007’s Every Last Meal: Every Bite and Sip of the World’s Greatest Agent and Playing Games with James Bond.

You can learn more about the fan events Matt hosts at BondFanEvents.com.

Collectibles Insurance Services was founded by collectors, for collectors! Homeowners insurance often falls short when it comes to providing coverage for collections, so that’s where we step in. We help insure collections of all kinds — from LEGOs to sports memorabilia, and comic books to toys, and so much more.

Find out what types of collections we insure or get a quote today!