Protect Your Passion: Essential Autograph Collection Insurance Guide

Protect Your Passion: Essential Autograph Collection Insurance Guide

Discover how to safeguard your autograph collection with essential insurance tips. Protect your passion and ensure peace of mind—read the article now!

Why Collecting Autographs Continues to Grow in Popularity

Autograph collecting has become a captivating blend of history, culture, and personal passion. The appeal of having a signature from a beloved celebrity or historical figure creates a unique connection, allowing fans to feel a direct link to their idols.

From iconic musicians to legendary athletes, these signatures are sought after for their sentimental value and their potential to appreciate financially. This makes autograph collecting both a joyful pursuit and a savvy investment for many collectors.

What Makes an Autograph Valuable to Collectors and Insurers

The value of an autograph is determined by factors like rarity, condition, cultural relevance, and authenticity. Understanding these is essential for buying, selling, and ensuring proper insurance coverage for collectibles.

Key factors affecting autograph value

- Rarity: The scarcity of an autograph, particularly from notable figures, significantly impacts its value. The rarer an autograph is, the more valuable it tends to be.

- Condition: Like any collectible, the state of an autograph plays a critical role in determining its worth. Good condition is essential; factors such as creases in corners or edges and any noticeable signs of handling can detract from its value.

- Cultural Relevance: The significance of an autograph varies by the figure it represents. Sports fans may seek legends like Babe Ruth, classic Hollywood enthusiasts often favor stars like James Dean and Marilyn Monroe, while music fans typically pursue icons like Elvis Presley.

- Authenticity: Above all, an autograph’s authenticity sets it apart from forgeries. Verification of an autograph’s genuineness is vital for establishing its true value.

Insuring your autograph collection

If you own a valuable autograph, it is wise to consider insuring it. Standard homeowners or renters’ insurance policies may not adequately cover these items. Homeowners’ policies pay claims at actual cash value.

Opting for a collectibles insurance policy can provide comprehensive coverage tailored to your collection’s specific needs, offering financial protection against loss or damage. Collectibles insurance protects against accidents, theft, fires, floods, hurricanes, and earthquakes.

In addition, collectors’ insurance ensures coverage for items being shipped or stored off-site, safeguarding your investments in valuable autographs.

The Importance of Authentication and Documentation

A signed item is only as good as the documentation behind it. Certificates of authenticity (COAs), photographic proof, and reputable dealers provide the foundation for autograph authentication services and insurability.

Proper documentation is essential for establishing the legitimacy and value of signed items, ensuring that collectors can have confidence in their investments.

Autograph authentication

Authenticating an autograph is crucial for both collectors and sellers. An authenticated autograph holds significant value, as the right documentation helps to establish legitimacy and authenticity.

Several factors are taken into account when opting for professional autograph authentication services. These include the historical significance of the figure, the rarity of the item, the medium in which the autograph was obtained, and the overall condition of the signed item.

The role of insurance

Having a Certificate of Authenticity (COA) is vital not only for validation but also for insurance purposes. A COA plays a key role in determining the value of an autograph, providing necessary details that inform coverage.

In the unfortunate event of damage or loss, proper documentation ensures that collectors can claim the appropriate compensation, giving them peace of mind and protecting their investment.

The significance of documentation

The value of signed items greatly depends on the accompanying documentation. A robust system of record-keeping—including COAs, expert evaluations, and photographic evidence—forms the backbone of autograph authentication and insurability.

Proper Storage and Display: Preserving Your Collection’s Integrity

Preserving your collection is essential to maintaining the condition of your autographs. The way you store and display your items plays a critical role in whether their condition is preserved over time.

Taking proactive steps to protect your signed memorabilia can significantly enhance its longevity and value.

Displaying your collection

If you want to showcase your collection, it’s important to do so in the right way. Utilizing UV-blocking display cases is a smart move, as they help shield your items from harmful light exposure.

Additionally, having the images professionally framed using archival-quality materials can make a substantial difference in preserving your autographs for years to come. For trading cards, make sure they are stored and displayed in archival-quality sleeves.

Proper storage techniques

The storage environment of your collection is equally important. It’s advisable to keep your memorabilia in a climate-controlled space where both temperature and humidity are regulated, as fluctuations can lead to damage.

Moreover, light exposure should be minimized; choose a storage area that is dark or has limited light exposure to prevent your items from fading and deteriorating.

Handling with care

Lastly, remember that physical handling can also impact the condition of your autographs. When interacting with your collection, be sure to handle each item carefully.

Washing your hands before touching them is a good practice, ensuring they are free of oils and dirt that could cause damage. Taking these precautions will help maintain the integrity of your prized possessions.

Getting Your Autograph Collection Appraised for Insurance

To ensure your collection is properly covered, obtaining a professional appraisal is essential. This section delves into how appraisals function, when to update them, and what insurers typically expect.

Importance of professional appraisals

When it comes to autograph insurance, a professional appraisal is often required by insurance companies.

Appraisals typically follow IRS regulations and USPAP guidelines, with appraisers assigning values based on current market value or replacement cost for insurance. They charge fees for their research.

To optimize appraisals, maintain a detailed inventory of items, including purchase price, seller/auction house information, relevant documents, and grading from services like PSA/DNA. Photographs can also serve as valuable documentation.

Updating your appraisal

The frequency of updating your appraisal can vary based on your insurance company. Generally, it is advisable to update your appraisal every 3 to 5 years to reflect the current market value of your items.

Insurer expectations

What insurers expect to see can vary between companies, but typically, you will need to provide documentation, authentication, and an appraisal from reputable sources. This ensures that your collection is accurately valued and covered.

Collectibles Insurance Services

At Collectibles Insurance Services (CIS), we simplify the process with minimal paperwork. Unlike standard homeowners’ insurance, we typically don’t require a schedule or appraisal for most items, except for those valued over $25,000, which do require scheduling. You are still responsible for maintaining your own inventory for insurance purposes in case of a loss.

Interested in learning more about Collectibles Insurance Services? Check out our website!

Tailoring Insurance for Your Specific Type of Autograph Collection

Different categories of collectibles, such as celebrity memorabilia, sports items, political artifacts, and literary works, exhibit varied levels of insurability and associated risk. Recognizing these differences is crucial for collectors who wish to protect their valuable items through tailored insurance policies.

Tailored insurance policies

To ensure that your items are adequately covered, it is important to have policies that cater specifically to the nature of the collectibles. For instance, the risks involved in insuring a sports autograph may differ significantly from those of a historical document.

Types of memorabilia insurance

When considering insurance options, it is important to understand the different categories that might require specific coverage:

- Sports Memorabilia: Items like autographed jerseys, balls, and photos may be covered under sports memorabilia insurance. This type of insurance has unique risks related to authenticity and market value, including accidental breakage during shipping and transit.

- Historical Documents: These are typically rare items with significant historical relevance. Insurance for such documents requires careful consideration of their provenance and condition.

- Entertainment Memorabilia: This category includes items like signed photos, scripts, or concert memorabilia, which can be influenced by a celebrity’s fame and market popularity.

- Political Artifacts: Collectibles related to historical political events or figures often require specialized insurance due to their unique significance and potential fluctuations in value.

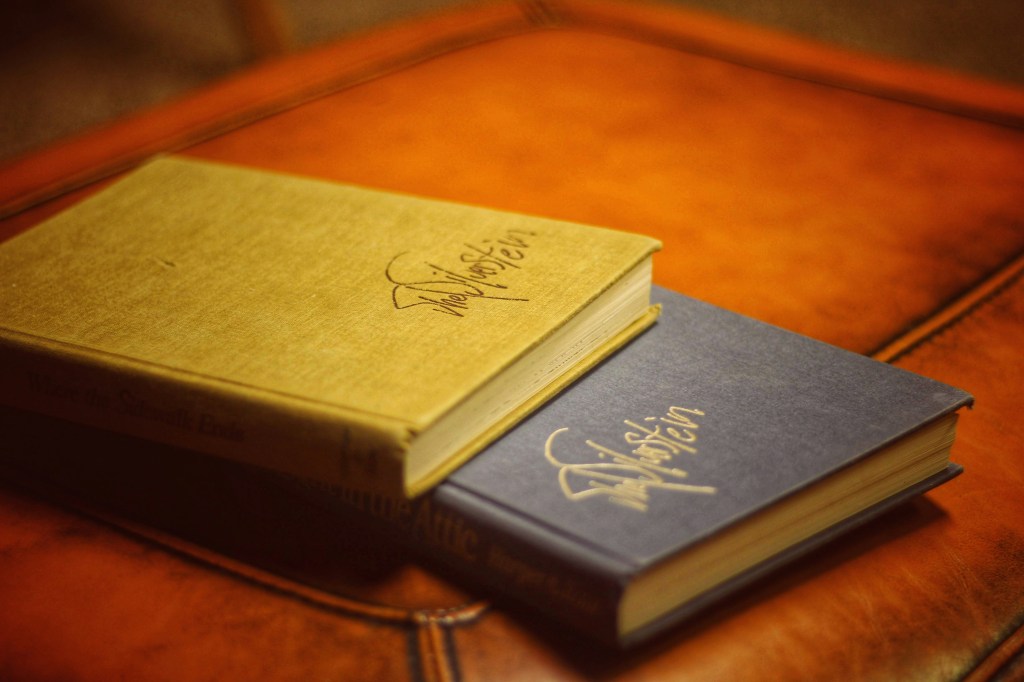

- Literary Collectibles: First editions, signed books, and manuscripts are included here. The literary market can be unpredictable, necessitating tailored policies for effective coverage.

Insuring your collectibles

When insuring autographs and special collections, it’s important to consider each item’s specific category. Consult with your insurance provider or insurance agent for advice on the coverage options that best fit your collection.

Choosing the Right Insurance Policy for Your Autograph Collection

Homeowners’ insurance rarely provides adequate coverage or proper valuation for collectibles, particularly those with niche value, such as autograph collections.

A specialty autograph collection policy provides coverage against theft, fire, water damage, and accidental loss during transit or display.

Finding the right insurance provider

To protect your collection, research companies that offer coverage for collectibles, such as Minico Collectibles Insurance, American Collectors Insurance, and Collectibles Insurance Services (CIS). Evaluating these options will help you find the right fit.

Reputation matters

When selecting an insurance provider, consider its reputation and financial strength. Look for positive reviews, a streamlined claims process, and excellent customer service.

At CIS, we pride ourselves on superior customer service tailored to collectors. Founded by passionate collectors, we understand the specific interests and needs unique to collectors. Our experienced adjusters prioritize prompt and personal claims service, ensuring a quick and thorough resolution for claims.

Cost considerations

Comparing costs is a best practice when selecting insurance. The cost often depends on the value of your collection, how it is stored, and its security level.

At CISs, we provide more affordable rates than typical homeowners’ policies, with deductibles starting at $0. Our coverage protects the market value of your collection for losses over $50. We also offer an optional inflation guard for new and existing collections, featuring a monthly coverage increase of 1%, up to $1 million.

Understanding conditions and exclusions

It’s crucial to grasp the conditions and exclusions of any policy you consider. Some companies may limit coverage for certain types of collections, so be sure to read the fine print.

At CIS, we offer comprehensive coverage for accidental breakage, burglary, fire, flood (excluding zones A & V), theft, natural disasters, and more, unless otherwise excluded.

Areas of exclusion

Be sure to check the exclusions, as they can vary by policy. Review your selected policy carefully.

At CIS, common exclusions include government seizures or destruction of property, war and nuclear hazards, gradual deterioration like fading or creasing, damages caused by pest infestations, and mysterious disappearances.

Risk Management for Collectors: Best Practices and Common Pitfalls

This section offers practical advice on minimizing insurance claims for your autograph collection. Key strategies include maintaining detailed storage logs, regularly rotating displays, and photographing items often. These practices help track your collection and are crucial for filing claims. It’s also important to avoid common mistakes that could impact eligibility or payout.

Risk management

Effective risk management is vital for autograph collectors. Understanding how to protect your collection from potential damages and losses is essential.

This includes ensuring that all items are documented thoroughly and that you have a clear inventory of your signed pieces. An informed approach to risk can save you considerable time and hassle in the long run.

Display and storage

How you display and store your collection significantly impacts its preservation and insurance coverage. Best practices recommend storing items in a temperature and humidity-controlled environment, as fluctuations can warp and damage the pieces. Some collectors opt for a storage facility, but it all depends on what your preferences.

Aim for a cool, dry space and keep items away from direct sunlight, as UV light can fade and damage autographs. It is also highly recommended that you use archival-quality, acid-free materials for framing and storage.

Security measures

Securing your collection is another critical aspect of risk management. Depending on the value of your items, investing in a security system may be necessary. This can provide peace of mind and protect your collection from theft or damage, ensuring that your treasured signed items remain safe and secure.

When and Why to Increase Your Coverage Limits

As your collection of autographs expands or as the market for them experiences an upswing, it becomes increasingly important to reassess your coverage limits.

Many collectors often delay this process, which can lead to underinsured losses in the event of damage or theft. To safeguard the value of your autographs, ensuring you have adequate insurance coverage is essential.

Regularly reviewing your policy limits protects your collection and keeps you updated on the market value of autographs.

Final Thoughts on Preserving Passion and Protecting Value

An autograph collection is more than just a hobby; it’s a valuable archive of history and culture. Proper care, documentation, and insurance are crucial for protecting these signed memorabilia and collectibles.

By investing in insurance, collectors can safeguard their investments, ensuring that their cherished items are preserved for future generations.

Sources

https://www.juliensauctions.com/en/articles/collecting-celebrity-autographs

https://www.justcollecting.com/blogs/news/autograph-collecting-the-7-things-you-need-to-know

https://www.ha.com/worth/autographs-value.s

https://www.taminoautographs.com/blogs/autograph-blog/investing-in-autographs-6-things-you-need-to-consider

https://www.ebsco.com/research-starters/sports-and-leisure/autograph-collecting

https://www.taminoautographs.com/blogs/autograph-blog/autograph-collecting-101-a-beginner-s-guide

https://www.thefandom.site/insuring-your-autograph-collection-a-complete-guide/

https://www.ha.com/information/appraise-faq.s

About Collectibles Insurance Services

Collectibles Insurance Services has been protecting collections since 1966 and all coverage is provided by a carrier with a group rating of “A” (Excellent) by AM Best, the leading rating agency for the insurance industry.

Comprehensive coverage includes, but is not limited to: accidental breakage, burglary, fire, flood, loss in the mail, theft, natural disasters, and other causes of loss unless specifically excluded from the policy. Deductibles start at $0 for collector policies and we provide coverage for the market value of your collection for losses in excess of $50.

Additionally the protection extends At home and away, and we don't require collection itemization and serial number nor extensive paperwork and red tape.